Although the coronavirus has postponed the implementation of new IR35 rules for a year, on 6 April 2021, the tax legislation changes came into full effect. Constituting the biggest change to employment tax, the new IR35 rules for the private sector aim to prevent tax avoidance over the fears that a growing number of contractors are now working as “zero-right” employees.

The consequences of these tweaks to the legislation are far-reaching, especially for industries that rely on contracting, and the IT sector is one of them. Before we delve deeper into the IR35 impact on the IT industry, here’s a bit of the context.

What is IR35?

IR35 is not new. Also known as intermediaries legislation, it is a set of tax laws that was first formally introduced by Her Majesty’s Revenue and Customs (HMRC) in 2000 to counter tax avoidance using the PSC (personal service companies).

But since in many cases HMRC struggled to enforce the rules, in 2017 the Off-payroll working rules shifted the responsibility for correct implementation of IR35 in the public sector from PSC to public sector bodies. As of April 2020, the same became applicable to the private sector.

Now, private sector businesses are responsible for correctly determining if IR35 is applicable to any contractor they hire. A contractor may not be on the company payroll but if they are subject to the same working conditions and comply with the same procedures as full-time employees, they will be seen by HMRC as “disguised employees”.

Basically, it boils down to this:

- Being “inside IR35” means that HMRC sees you as an employee and you have to pay income tax and National Insurance Contributions (NIC).

- Being “outside IR35” means that HMRC considers you genuinely self-employed and you can benefit from tax efficiency that self-employment brings.

How to determine the status

HMRC rules and procedures can be complex and even ambiguous. But to help businesses and contractors identify the IR35 status, the statutory body has developed a special tool called CEST (Check Employment Status for Tax).

To assess whether an engagement falls inside or outside IR35, HMRC relies on a number of factors. What’s more the status may vary from contract to contract. The core principles include:

Control

The key determinant of the IR35 status is the extent to which a client can dictate a contractor’s working hours, method of work, who they report to, etc. Self-employed contractors are not under the direct supervision of a company meaning they are free to determine when, where, and how they perform work they are hired to do.

Substitution and personal service

A contractual agreement is deemed to be IR35-friendly if it contains a clause that allows a contractor to provide an equally qualified substitute or to sub-contract while retaining the risks associated with it.

Mutuality of obligation

Mutuality of obligation (MOO) refers to the employer’s obligation to provide work on a constant basis and the employee’s obligation to do the work. That said, self-employed contractors do not expect any further work beyond the task they were hired for.

Financial risk

While employees carry practically no financial risk during their employment, self-employed contractors can be exposed to a greater level of risk — early project termination, budget overrun, or bad debt.

Part and parcel

The part and parcel test aims to determine to which extent a contractor becomes an integral part of the end client’s business. A truly self-employed contractor is merely an accessory to an organization.

Provision of equipment

Although a minor factor, it still can be used to assess the employment status. A rule of thumb is that if you provide your own equipment, you are financially accountable for it, therefore you are more likely to be a self-employed contractor. And if you use the company’s equipment, it could mean that the company controls how and where you do your work, meaning you are an employee.

Is the IT industry ready?

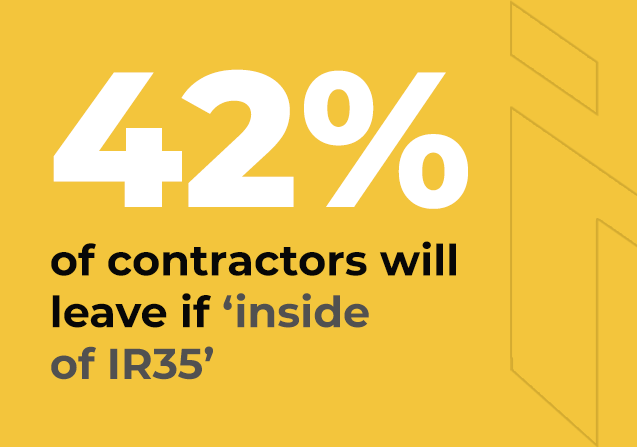

Since many companies depend on contractors to boost their software development capacity, the new IR35 rules can have a serious impact. Almost 75% of companies in the UK admitted they are not ready for the upcoming changes. The growing concern is that genuine contractors will be identified as employees, which will make them suffer from unfair taxes or refuse contracts altogether.

The Office for National Statistics (ONS) has already seen a 2.4% decline in IT contractors, with even more prepared to leave. All this contributes to the increasing fear that these rules will only exacerbate the problem of skills shortage.

Source: Salt Survey, 2019

Acquiring talent in a safer way

Software development talent is a crucial part of staying competitive and continuing business as usual. But the disruption caused by the IR35 reforms makes companies revisit their contractual arrangements in order to move forward.

Given the extra taxes, benefits, and payments, it’s highly unlikely that companies will hire all their contractors as full-time employees as this would be an unreasonably expensive way to mitigate the “disguised employees” problem.

Another way that many organizations now choose is to outsource their IT needs outside the UK where IR35 is not applicable. Nearshore IT outsourcing can help companies not only effectively close the skills gap but also keep software development costs under control and ensure greater business agility.

In fact, IT outsourcing is a growing trend even in countries not subject to IR35 legislation. By the end of 2021, the global IT outsourcing market is expected to amass $413 billion. Further growth is forecasted to be at the level of 5% up to 2024. According to Avasant’s IT Outsourcing Statistics report, the most outsourced functions include application development, cybersecurity, and network operations.

The bottom line

As the new changes to IR35 have just come into effect, we’ll need some time to see what the consequences will be in the long-term perspective. To secure the software talent, strategically-driven companies are already engaging extended overseas teams for their IT projects.

The advantages of outsourcing your IT needs to overseas contractors are numerous. In addition to competitive rates, a mature IT outsourcing provider brings to the table years of development experience, saving the client more time and money through better risk management and faster time to market. Companies can then focus on their core business without spending limited resources on complex IT decisions. The flexibility of different engagement models (dedicated development teams, time and materials, fixed costs) allows the client to choose the best fit for each project and achieve great business outcomes.