“The threat that inspires” – here’s how insurtech is referred to in media. Indeed, the innovation that comes to the industry has the disruptive nature. Well, it’s very early days for insurtech startups to transform the market but high customer expectations and rough competition encourage industry leaders to weigh the opportunities and risks of the future innovation.

That said, traditional insurance companies find the ways to partner with insurtechs and gradually adopt groundbreaking technologies into their business lines.

Take a look at the latest statistics from McKinsey&Company: insurtech companies have already embraced all major insurance branches, placing a particular focus on the property-casualty business and distribution process.

What is insurtech?

When you look at these statistical data, the output is as simple as that: the trend is progressing but the numbers are still too small to make sense when analyzing them.

This can be explained by very early days of the area, and a lot of insurance businesses have no idea of what it is or are still hesitant about implementing innovation to their organizations. Let’s see what it’s all about.

The concept of insurtech was inspired by the other traditional business disruptor – fintech – which has already won the market of financial services companies. In fact, the explanation of the word lies in its very notion: insurance + technology – and means the innovation that transforms the insurance industry to comply with the rapidly-changing needs of the modern generation of insurance buyers: lower cost, higher efficiency, and better targeting through customization.

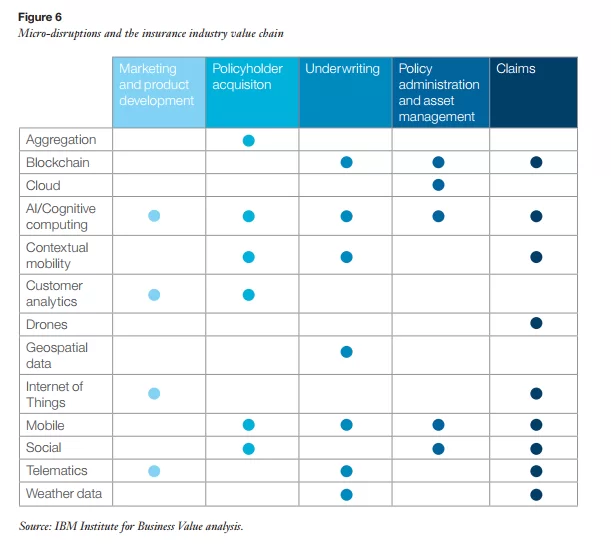

What is the innovation that comes with insurtech revolution? The recent research from IBM gives insight into the core micro-disruptions and their effect on the value chain:

Further, we will have a closer look at three areas in insurtech: AI, blockchain and IoT that is nothing more than buzzwords where it’s still unclear how to apply them for old vanilla actuarial tables and paper insurance policies.

Artificial Intelligence & Machine Learning: predictive analytics and automation

How it works:

Artificial intelligence exploits the power of robotics to identify behavioral patterns (which could hardly be detected by humans) and provide predictive analytics, risk assessment, pricing assessment and manual tasks automation. On top of this, chatbot technologies may successfully interact with customers through a web chat or call center software.

Solutions:

- Virtual personal assistants allow for AI-based customer data analysis for custom policy tailoring, complementary services or policy extension.

- Predictive analytics powered by machine learning prevents expenses on claims by predicting environmental catastrophes, helps salespeople qualify leads with improved targeting.

- Robotic process automation facilitate the work of agents by claims staging, bundling services and automatic task completion.

Example:

Clark in Switzerland uses the power of artificial intelligence and bots to analyze the entire insurance market and offer robo-advice to optimize specific insurance.

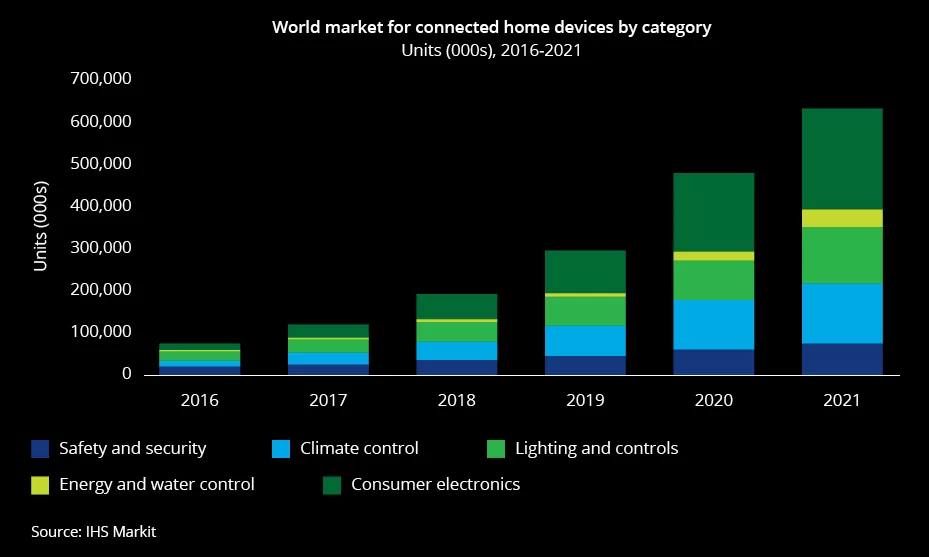

Internet of Things: connected devices and real-time data

How it works:

Connected devices, sensors, wearables collect data and build behavioral patterns to assess risks and track the activity. As a result, insurers get interactive touch points with a customer in real time, can offer tailored services or usage-based insurance, as well as reduce frauds and bogus claims.

Solutions:

- Connected home may include climate, energy, water, lighting control, window and door sensors that help monitor their usage and enhance customer experience with customized policies. What is even more important, one can install flood and fire detectors that will notify emergency services in case of danger.

- Wearables track the lifestyle to collect the data as it is in addition to doctor reports and standards. It is mostly a value-added solution, which is not the incentive in decision-making.

- Telematics devices are installed into a car to track the time of the day and night when someone is driving, the speed, mileage, intensity of acceleration or pressing brakes. Then, they send reports to the insurance company to customize the policy for each vehicle.

Example:

Accuscore determines accurate predictions by scoring driving risk based on the interpreted data collected from telematics devices, video cameras, and a smartphone app. It allows insurers and drivers to identify aggressive or distracting behavior on the road and anticipate risky driving events.

Blockchain: database security and connectivity

How it works:

Blockchain brings two main benefits to the insurance industry: fraud management and cost reduction for claim processing. Due to its decentralized nature, it provides enhanced security, trust and speed around transactions.

Despite the evident advantages that come with blockchain-based solutions, companies are reluctant to adopt it yet, due to the complexity of the decentralized model and vaguely-defined standards of adoption.

Solutions:

- Blockchain for P2P insurance combination ensures automation through smart contracts and guarantees payout to blockchain residents.

- Data verification allows for minimization or reduction of error, as an insurance company doesn’t need to rely on customer’s version of the truth.

- IoT enablement allows sensor hardware and devices to send information in real time with increased transparency.

Example:

Deloitte developed a solution for handling product warranties and insurance with the help of blockchain technology. Namely, they allow to store receipts, check the legitimacy of products making the insurance process more secure. For the use case, watch their video:

Elinext in Insurtech

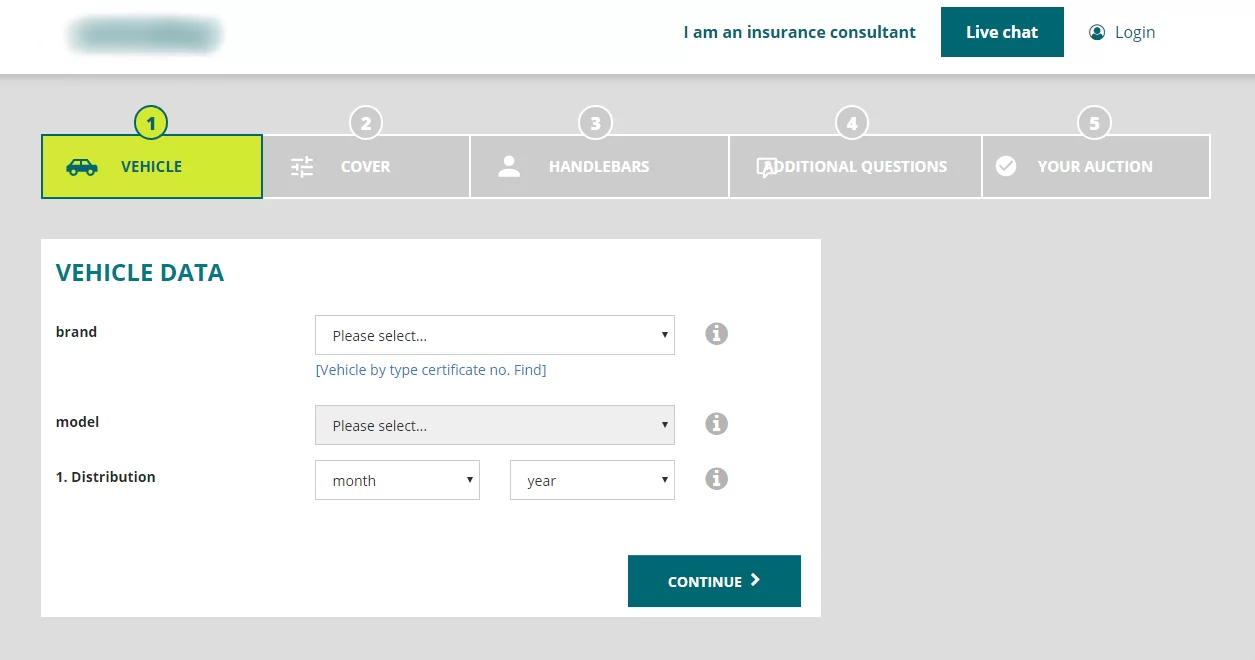

Elinext have broken into insurance industry years ago and keeps going with the times, switching their focus to insurtech innovative solutions. One of our latest projects features a B2C car insurance auction where multiple insurance providers compete for customers offering them better deals than their peers. Car owners can anonymously compare policy offers from insurance companies in real time.

Some predictions from Elinext

- The main challenge for insurtech today is the improvement of insurance value chain; however, this focus will be switched to disintermediation, P2P models, and blockchain, reducing the delivery time and cost.

- Freshly emerging insurtechs are a bit cautious about stepping in the new industry and try to concentrate on some single area. Further on, the entire value chain will be rethought with full-stack digital insurers, which will provide lifestyle policy including everything from property to health and travels.

- Insurtech will connect closer to fintech by consolidating full-stack digital policies with wealth management tools and robo-advisors.

Final Thoughts

At the end of the day, traditional insurance models will need to adapt or fall prey to the all-embracing wave of innovation being unable to compete. That’s why it’s time for insurance companies to analyze their strengths and weaknesses and consider ways to move forward through partnering with insurtechs and keeping a close eye on market demands.

In the tech world, AI, IoT and blockchain are no longer marketing keywords but working concepts that will provide better experiences for the next-generation customers allowing them to reduce costs, get a tailor-made policy, and even prevent accidents. It becomes clear that insurtech is a train that blows full steam ahead. Want to jump on the bandwagon? Contact Elinext for professional insurtech consultancy.