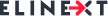

New technologies are actively transforming the financial and banking sectors today, replacing traditional business models. Integrating innovative financial solutions allows companies to improve the efficiency and quality of business processes, reduce costs, change the consumption structure, attract new customers, and increase their loyalty. The digitalization of the banking and financial market is facilitated by the rapid development of the mobile technology industry. Statista graphics below shows that the number of mobile users worldwide reached 7.1 billion in 2021 and is expected to grow to 7.26 billion by 2022.

Source: Statista

Smartphones, tablets, and other gadgets allow people to chat, have fun, communicate, study, work, and trade online. Accordingly, new living conditions and demands require new ways of handling finances. Therefore, banks and fintech organizations are introducing modern solutions based on blockchain, artificial intelligence, big data analysis, contactless and biometric technologies, and many others in order to adapt to market changes and offer customers unique products and services.

The coronavirus pandemic has also accelerated the transition to new technologies. Many users began to make purchases, pay for services, and resolve bank issues on the web for the first time. People had no choice, and millions of customers had to turn to digital services very quickly. They connect to mobile banking, set up fast payment systems, learn how to make payments online, and go cashless.

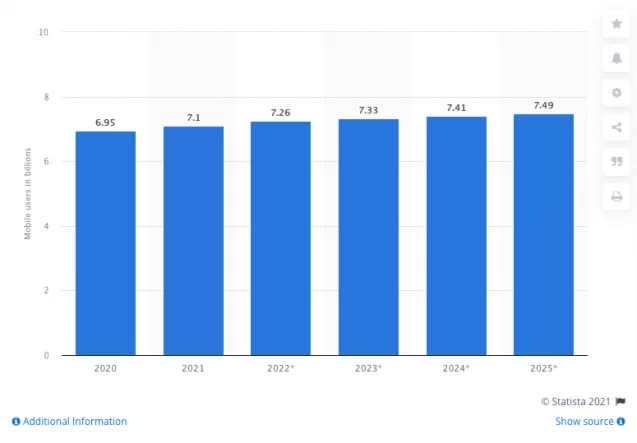

All of these options were available before, but not everyone used them. For example, Plaid found out that 59% of Americans started using more fintech apps after the pandemic. 80% of respondents said that money management apps helped them avoid going to the bank. Users noted the following benefits in using fintech applications during the COVID-19 times:

Source: Plaid

It’s obvious that digital banking solutions will stay in demand and even gain more popularity in the future when the pandemic limitations are lifted. For example, 73% of the participants in the above-mentioned study plan to continue using fintech apps after things get back to normal. On the contrary, the market for innovative products will expand, and startups will develop and offer customers unique tools, both for banks and financial institutions and for users and clients of these institutions.

Investments in fintech are now growing at a tremendous pace. According to CB Insights, US fintech companies raised $12.8 billion in Q1 2021, up 220% over the same period in 2020. The most popular financial and banking solutions include the following:

- Financial management apps that help users analyze their current assets and predict future expenses (Pocket Guard, Mint, Honeydue)

- Applications that allow people to pay for goods and services without using a mobile terminal. Instead, customers apply their smartphones, smartwatches, or wristbands (Samsung Pay, Apple Pay, PayPal)

- Apps that allow users to transfer money without intermediaries from anywhere in the world at any time (CashApp, Zelle, WorldRemit)

- Services that help customers can take out a loan without the participation of banks. For example, the American startup CommonBond provides graduates with refinancing educational loans at low rates.

- Investment platforms, also known as Wealthtech, that use artificial intelligence and machine learning to help investors find the most profitable options in the market.

- Applications, also known as InsureTech, are aimed at improving the existing insurance model and making it more efficient. For example, the idea of the Spixii startup is to install special sensors on their customers‘ cars that track their driving style. Poor driving habits make insurance costs more expensive. If a person drives calmly, without breaking the rules, he or she will get a car insurance discount or higher compensation.

- Security systems allow banks to protect themselves from fraudsters and provide customers with authentication measures. According to IBM research, 56% of people would call to place an order or go to a physical store if their apps had any security or privacy issues. That’s why it’s important to ensure the highest data protection and privacy level. Nowadays, developers implement biometrics and multifactor authentication features in their solutions.

- Big data applications automatically aggregate accounts and analyze data, allowing banks and financial organizations not to request various statements, statements, and other documentation and manually enter all this information into the system. As a result, companies get a chance to significantly save their time and automate business processes.

This list can be extended with financial apps and platforms based on blockchain and smart contracts, RegTech solutions, crowdfunding services, open banking platforms, neobanks, and other up-to-date technologies that are currently gaining momentum. Let’s see how all these solutions can benefit both businesses and customers.

Exploring Advantages Provided by Fintech Apps

Financial and banking applications improve the company and customer communication, making it more effective, relevant, and consistent. Digital solutions allow users to perform their tasks cheaper, faster, and more seamlessly. They offer people the following benefits:

- dealing with money in a more convenient way;

- the ability to control income, expenses, and keep a record of transactions;

- laying out expenditures and figuring on extra income;

- having 24/7 access to the financial transactions, data, and functions;

- no need to directly contact banks to work with them;

- automation of flow financial processes, for example, payment of utility bills, payments on loans, and so on;

- customization of the app according to customers‘ needs;

- convenient interaction between financial institutions and clients;

- making fast and seamless payments;

- binding payment cards.

Financial institutions and banks, in turn, will get the following benefits from using top-notch apps:

- entering the digital space and taking solid positions in the market;

- reducing the operational, personnel, and rental costs;

- reducing paper workflow;

- reducing a considerable number of errors caused by human factors;

- significant acceleration of processing operations, automation of business processes, and reducing the processing time of customer requests;

- creating new technologies that help to implement modern approaches in the work of banks and financial organizations;

- optimizing work processes based on processing a large amount of data, reducing the cost of organizing and marketing activities;

- increased efficiency because digital solutions don’t need days off and holidays, don’t get sick, and can operate all day;

- implementing new unique tools that increase customer loyalty and improve the quality of services.

Emerging technologies allow financial companies and banks to target new customer groups, develop applications that meet their needs, improve customer service, increase customer loyalty, and modernize business processes. Moreover, they will be able to provide their clients with personalized financial, investment, and insurance products. The Gartner research demonstrates that only 12% of clients think that businesses can meet their demands when we are discussing personalization. So, banks and financial organizations can use new solutions to become more customer-focused as Netflix did. It uses special tools to track users‘ habits in order to recommend them the right content. This approach helped the streaming service to boost sales by 60%.

5 Major Digital Transformation Pitfalls in Fintech in the USA: How to Avoid Them?

In spite of the fact that online solutions open up new opportunities for businesses and customers, there are barriers that hinder the digital transformation of fintech and the banking sector in the United States. Let’s take a closer look at them.

#1 Growing cyber threats and an active fight against cybercriminals

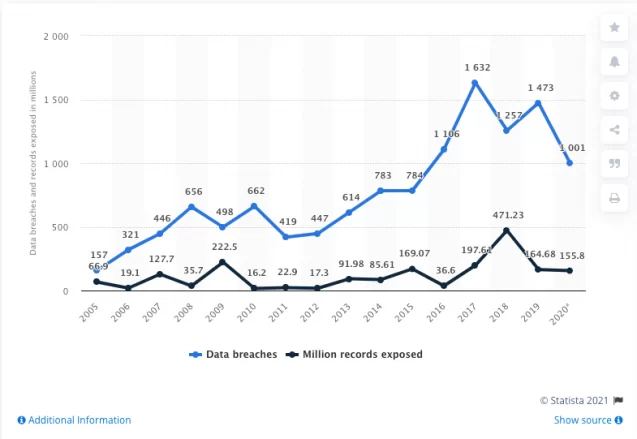

When users download and install financial applications on their devices, they are primarily concerned about the safety of their funds and personal data. The app can be attractive and user-friendly, but all of these features are negated if they don’t include the latest security measures. Statista data to show that more than 155.8 million people lost their private information in the United States in 2020.

Source: Statista

Intertrust analyzed 150 financial apps and found that 70% of iOS solutions and 84% of Android products had at least 1 high severity or critical vulnerability. To protect users‘ personal data and assets, developers must implement innovative security measures in their financial apps and platforms. This will motivate more customers to download fintech apps and sleep with a peaceful mind.

#2 Lack of qualified staff

According to The Future of Jobs 2020 report prepared by the World Economic Forum, the technological transformation will change the business objectives and job structure by 2025. Every second employee will have to undergo retraining because they won’t be able to perform their jobs. The Accenture survey revealed that 26% of banking managers believe that only one in four of their employees are able to cope with AI solutions. If financial institutions and banks want to overcome this barrier, they should think about their staff and take care of their training. At the same time, 97 million new jobs in the field of cloud technologies and artificial intelligence are expected to appear by 2025, which will help businesses to close the skill gap.

#3 Slow regulation changes in the fintech and banking sector

There is no unified system for regulating fintech and crypto business in the United States now. Their activities are regulated by separate laws at both the federal and regional levels. To do business, these companies must obtain the appropriate licenses. For example, 49 states, the District of Columbia, and Puerto Rico require the entities rendering the payment transfer and other financial services to obtain special licenses. Moreover, the requirements and conditions of licensing are very different in every state.

In September 2020, the US authorities announced the creation of rules for obtaining a single license for fintech activities. However, only large market participants can take advantage of this opportunity. Nevertheless, the American legislation is gradually changing, and it is predicted that each fintech startup will be able to enter the US market in the near future.

#4 Different business styles and organizational cultures

Fintech startups are more flexible in contrast to most banks that have a rigid hierarchical management structure. For this reason, digital companies find it difficult to integrate their creative solutions into the conservative business processes of banks. But clients require new, personalized services, making 77% of financial organizations apply innovative technologies in order to increase customer loyalty and retention.

#5 Digital literacy of users

The US Department of Education conducted a study in May 2018 to determine the level of digital literacy. They revealed that 31.8 million Americans lack digital skills. There are people from older, less educated, and poorer groups of the population who don’t have computers or Internet connection at home. The US government plans to allocate $2 trillion in order to address the digital divide and help people get access to digital infrastructure.

Do You Want to Win the Competition in the Fintech Market?

Digital financial solutions transform the banking sector, opening wide opportunities for companies and their clients. They markedly simplify the business processes, cut operating costs, reduce transaction time, improve user experience, and much more. The COVID-19 pandemic boosted the digitalization of the financial industry, making rigid banking structures integrate new-age apps and platforms more actively.

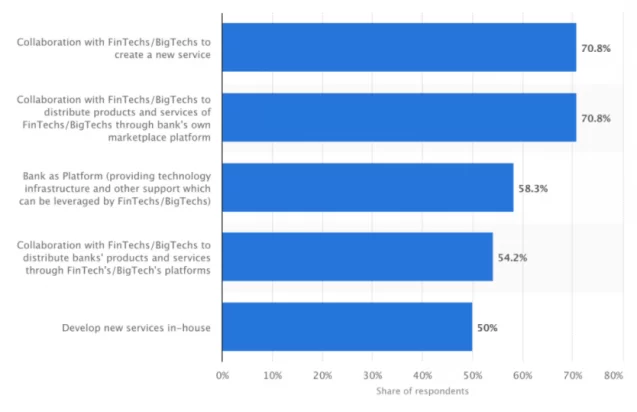

Finastra’s research confirms the intent and readiness of banks to cooperate with fintech companies. According to the report, 70-75% of banks are already implementing new technologies or plan to do it next year. The graphics below shows that banks clearly understand how startups can help them become more competitive and offer better services to their customers. It’s no wonder that the largest American banks have already invested $3.6 billion in 56 different fintech companies.

Source: Statista

There are some challenges that prevent the fintech market participants from diving into their digital journeys to the fullest extent, but they can be overcome in the near future. If you want to join the fintech world, you don’t need to wait until these issues are solved. Take all advantages provided by fintech solutions right now! At Elinext, we have huge experience in delivering various financial solutions ranging from custom accounting software to insurtech solutions for clients and markets from all over the world. If you need advice or help, our specialists are ready to implement your idea.

Related articles:

How To Use Voice and Speech FinTech